Abstract

In many industrial sectors, firms amass large patent portfolios to reinforce their bargaining position with competitors. In a context where patents have a pure strategic nature, we discuss how the presence and effectiveness of a patent system affect the technology decisions of firms. Specifically, we present a game where firms choose whether to agglomerate (i.e. develop technologies for the same technological territory) or to separate (i.e. develop technologies for different territories) prior to taking their patenting decisions. We show that strong patents may distort technology choices causing firms to follow inefficient technology trajectories in an attempt to reduce their competitors’ patenting activity. We also discuss how such distortions change when a firm is prevented from obtaining its optimal number of patents.

Similar content being viewed by others

1 Introduction

In recent years, several industries have experienced a surge in patenting activities (see Comino et al. 2019). In high-tech sectors this has led to an increasing fragmentation in intellectual property rights and to the emergence of so-called patent thickets (Shapiro 2001). With patent fragmentation, firms rarely have full proprietary control over the technologies they employ; thus, they are often involved in licensing and cross-licensing agreements with their rivals in order to give themselves the freedom to operate.

In this context, firms have incentives to intensify patenting and to use their intellectual property rights strategically, as bargaining chips in negotiations (Hall and Ziedonis 2001). Amassing large patent portfolios is a way for companies to reinforce their bargaining position with competitors, improving their chances to strike better licensing deals. Piling up sizable patent portfolios may be beneficial either for defensive or for offensive reasons. In the former case, firms use their patents as a safeguard against the possibility of rival firms taking legal action for patent infringement (Ziedonis 2004); in the latter, firms may want to use the patents aggressively against competitors (Walsh et al. 2016; Torrisi et al. 2016), or use them to induce entrant firms to engage in collusive behavior (Capuano et al. 2020).

The proliferation of patents and their increasing fragmentation may have problematic consequences. Patent thickets may lead to multiple marginalizations and royalty stacking, and the associated increase in the distortions related to patent protection may eventually lead to reducing the use of patented technologies and to discouraging the development of follow-on innovations (Heller and Eisenberg 1998).Footnote 1

Intensified patenting activities may also distort the direction of firms’ research efforts. This is what is found in Hall et al. (2013). In their study, the authors employ data on nearly 30 thousand UK SMEs and find that the presence of patent thickets in a given technological field acts as an entry barrier in that area.Footnote 2 Similar findings are reported by Walsh et al. (2003) and Lerner (1995). The former study focuses on the pharmaceutical sector and finds evidence that companies tend to direct R&D investments to areas that are less covered by patents. Lerner (1995) looks at the patenting behavior of biotech firms and shows that companies with high litigation costs are less likely to patent in subclasses where many other patents are granted.

A noteworthy historical account of the effects of patents on the direction of innovation can be found in Moser (2005). Using historical data for the inventions presented at two World’s Fairs in the second half of the nineteenth century, Moser shows the different technologies trajectories of firms in countries with and without a patent system. Based on this evidence, Moser (2005) concludes by saying that “patents help to determine the direction of technical change”, suggesting that the presence, and the effectiveness, of a patent system can have an impact not only on the extent of innovation but also on its direction.

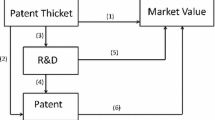

In this paper, we propose a theoretical model to study how patenting affects the technological trajectories of firms in a context where large patent portfolios are amassed for strategic reasons, i.e. to improve a firm’s bargaining position vis a vis a competitor. The interaction between two competing firms is modeled as a three-stage game. In the first stage, firms choose their technological trajectory, that is they select the area where they want to develop their technologies. If firms choose the same area, then we say that agglomeration occurs; if they choose different technological areas, then we say that there is separation. In the second stage, firms take their patenting decisions and develop their patent portfolios. The technological areas chosen by the two firms overlap to a certain degree, meaning that technologies and patents developed for one area can be (at least partially) used in the other area as well. In the third stage of the game, firms negotiate a cross-licensing agreement in order to use the technologies developed in the first stage. We model the licensing negotiations as a Nash bargaining game where a firm’s bargaining power endogenously depends on the strength of its patent portfolio. In this framework, we show that strong patent protection may distort the direction of R&D activities inducing firms to inefficiently concentrate on the same technological area in some cases or to excessively diversify their R&D projects in others. Specifically, firms may refrain from choosing the research trajectory which is optimal from the industrial point of view in order to induce the competitor to patent less intensively.

The main message of our analysis is that on top of the classical deadweight loss associated with the monopolistic position that they grant, patents can be the source of another potential inefficiency related to the distortion they may cause in relation to technology choices. Different contributions in the empirical literature have shown a high degree of heterogeneity in how effective patents are considered by firms (Cohen et al. 2000; Graham et al. 2009). This fact suggests that a strengthening of patent protection may distort technological choices favoring sectors and firms for which patents represent a more effective legal tool. Interestingly, our analysis shows that the distortionary effects of patents may also occur in a symmetric context, i.e. in symmetric technological areas and with patents evenly affecting firms and sectors.

Our paper contributes to the theoretical literature on the role of patents in stimulating innovation. Research in this field has focussed, almost exclusively, on investigating how patenting affects the scale of R&D activities (Hall and Harhoff 2012). Only a handful of articles looks at how some specific characteristics of patents may affect the direction of R&D. Bhattacharya and Mookherjee (1986) concentrate on the ‘winner-takes-all’ feature of patent races and study how firms choices are affected by the attitude to risk and by the distributional characteristics of the returns of research trajectories. When considering a context closer to ours – all trajectories are available to all firms – they find that maximum specialization (separation in our jargon) emerges in equilibrium, an outcome which is also efficient from the industry point of view. Chen et al. (2018) study the role of patentability standards and analyze how they induce firms to cluster and invest in a risky or safe project. The authors show that stricter standards have countervailing effects. On the one hand, they reduce the static incentives of investing in the risky project that may fail to lead to a patentable innovation; on the other hand, stricter standards increase the dynamic incentives to invest in the risky project by extending the period of incumbency. We contribute to this literature by focusing on some distinct features of patents and firms’ strategies in the context of high-tech markets. In these sectors, innovations are covered by patent thickets and firms accumulate sizable patent portfolios strategically in order to increase their bargaining power with competitors. As discussed above, this feature may represent an additional factor that induces firms to distort the direction of their R&D projects.

A relatively well developed literature has investigated the factors influencing the direction, rather than the scale, of firms R&D activities but, unlike us, this literature focuses on determinants other than patents. A series of papers looks at the reasons why firms select similar and correlated research projects. Technological clustering may be due to the presence of strategic complementarities (Cardon and Sasaki 1998) or to firms failing to internalize the effect of their choices on competitors, leading them to choose projects that are too similar compared to what would be efficient (Dasgupta and Maskin 1987; Hopenhayn and Squintani 2021). Another stream of research looks at how the market structure influences the variety and extent of duplication of R&D projects. Sah and Stiglitz (1987) find the conditions under which the overall number of research paths pursued in a market is independent of the number of firms. This work was extended by Farrell et al. (2002). In a more recent contribution, Letina (2016) highlights the positive effect of competition on the variety of projects pursued by firms, while Chatterjee and Evans (2004) emphasize the role of R&D cost heterogeneity in determining too much or too little duplication compared to the social optimum. Our contribution to this literature is to show how the patent system too can play a decisive role in determining firms technological trajectories, by revealing that the strategic use of patents can lead to excessive clustering (agglomeration in our jargon) or specialization (separation in our jargon).Footnote 3

Our analysis shares some modelling features with von Graevenitz et al. (2013) and with Choi and Gerlach (2017). In the former paper, the authors present a model in which firms first choose the technological area of their R&D activities and then decide how many patent applications to file. A central difference with our framework is that in von Graevenitz et al. (2013) the main focus is on determining a firm’s patenting activity and, more specifically, on disentangling the effect of complexity on the increase in patenting observed in the data. With Choi and Gerlach (2017), we share the idea that firms compete ‘armed with’ their patent portfolios. In more detail, in Choi and Gerlach (2017) firms compete to develop a new product; each firm owns a patent portfolio of a given size and strength and when one firm successfully develops a product it may infringe on some of the patents held by the other firm. A central assumption of the theory developed by Choi and Gerlach (2017) is that firms portfolios are exogenous. In reality, as discussed above, firms accumulate large patent portfolios to increase their bargaining position with competitors; it is therefore natural to assume that the size of firms portfolios is endogenously determined by firms patenting choices. This is where our paper contributes to the analysis in Choi and Gerlach (2017).

The paper is organized as follows. Section 2, presents the set-up of the model; Section 3 develops the analysis and sets out the main results while in Sect. 4 we present a couple of extensions to the baseline model. Section 5 concludes. The proofs of the results are presented in the mathematical Appendix.

2 The model

We consider two firms, A and B, operating in an economy comprising two adjacent markets, 1 and 2, each of which corresponds to a given technological territory. By technological territory we mean the set of technologies aimed at manufacturing products for a given market. The two territories are symmetric and overlapping i.e. technologies developed for one territory can be used, to a given extent, to realize products for the other. We refer to the degree of overlap with the term ‘technological proximity’. For example, one can think of mobile devices (tablets, smartphones) and personal computers. Clearly, several hardware and software technologies incorporated in a tablet can also be embedded in a personal computer, and vice versa; using our jargon, we say that these two areas are characterized by a relatively high degree of technological proximity.

The two firms are competing in the two markets and we normalize to zero their current/status quo profits. With the aim of boosting their businesses, the two firms conduct R&D activities aimed at developing and patenting new technologies. We model the interaction between firms A and B as a three-stage game; in the first stage, they simultaneously choose in which technological territory to direct their R&D efforts.Footnote 4 For the sake of simplicity, R&D costs are normalized to zero and the only expenses of developing technologies within a given territory are related to the opportunity cost of not investing in the other one. When firms choose the same territory, we say that agglomeration occurs; when they develop technologies for different territories, we say that separation occurs. After choosing the territory for R&D activities, in the second stage of the game, the two firms exert efforts to build their patent portfolios. Patents have a solely strategic nature and are used by a firm as bargaining chips in the third stage of the game, during negotiations with the competitor.Footnote 5 Specifically, we assume that in the third stage firms enter in cross-licensing negotiations and we represent such negotiations as a Nash bargaining process through which firms share the industrial profits. The portion of profits a firm is able to appropriate depends on the strength of its patent portfolio.

An important ingredient of our analysis is the degree of technological proximity between the two areas, a feature which we index with the parameter \(\beta \in [0,1]\). The larger \(\beta\), the more the technologies developed for one area can be employed to generate value in the adjacent area as well; this is due to what we call technological spillover, which increases with \(\beta\). In addition to this, a larger \(\beta\) also implies that patents protecting the technologies developed in one area have greater strength when practiced in the other area.

The level of industrial profits generated in an area depends on the amount of available technologies and, therefore, on firms technological choices. We model industrial profits in reduced form, disregarding the effects that firms technological choices may have on the degree and extent of competition. This allows us to focus on patenting as a determinant of firms R&D choices, abstracting from other possible factors that might influence the specialization strategies of companies such as competition at the product level. More specifically, suppose that firms choose to develop technologies for different areas so that separation occurs. We indicate with \(\Phi (\beta )\) the industrial profits generated in each area; due to the presence of technological spillover, they increase with \(\beta\): the higher the degree of technological overlap between the two areas, the more the technologies developed in a territory can be profitably used in the other area too. In the case of technological agglomeration, both firms develop technologies for the same area which, without loss of generality, we assume to be area 1. In this case, as no firm develops technologies specific to area 2, the value generated in this territory is minimal. The two firms can still use the technologies developed for area 1 but the value they generate in the adjacent market is necessarily limited. We refer to this value as \(\Psi (\beta )\), with \(\Psi (\beta )\) smaller than \(\Phi (\beta )\); in this case too, it is natural to assume that \(\Psi (\beta )\) increases with \(\beta\), as the greater the proximity the more the technologies developed for area 1 are better able to generate value in area 2 as well. By contrast, with agglomeration, industrial profits in area 1 are maximum, provided that all technologies are specifically developed for this area. Formally, this value is denoted with \(\widehat{\Phi }\), with \(\widehat{\Phi }\) larger than \(\Phi (\beta )\); clearly, since with agglomeration there are no technologies specifically developed for area 2, there is no spillover effect at work from area 2 to area 1 and industrial profits in area 1 do not depend on \(\beta\).

Putting everything together, the values generated in the two areas with agglomeration and separation are ranked as follows: \(\widehat{\Phi }>\Phi (\beta )>\Psi (\beta )\) for \(\beta \in [0,1[\), while \(\widehat{\Phi }\ge \Phi (1)\ge \Psi (1)\) if \(\beta =1\). The following table summarizes the values of the two technological areas in the two scenarios.

The third column of Table 1 indicates the sum of the industrial profits collected in the two areas.

Patenting and cross-licensing. In the second stage firms exert efforts in order to build their patent portfolios, \(n_i\ge 0\), with \(i=A,B\). Variable \(n_i\) is the outcome of the activities that firm i undertakes to protect its technologies through patents. These activities include the number of applications the firm files, the number of claims in each application, but also all the activities – from dealing with IP consultants, to the efforts in crafting patent applications appropriately or to bargaining with PTO examiners – that the firm puts in place to better shape its patent portfolio. The greater the efforts firm i exerts the higher \(n_i\). In what follows we assume that \(n_i\) is a continuous variable. For the sake of simplicity, all through the paper we refer to \(n_i\) as the number of patents the firm applies for or as the size of its patent portfolio. We assume that the cost to build a portfolio of size \(n_i\) is equal to \(c(n_i)= n_i\).

The strength of firm i’s patent portfolio depends positively on two factors: the size of the portfolio and the effectiveness of patents as an instrument of protection, a factor that we indicate with \(\sigma >0\). Parameter \(\sigma\) incorporates all those elements, such as breadth or scope of protection granted by the law, that make patents stronger. Formally, we assume that the strength of a portfolio of size \(n_i\) in the market for which the technologies it covers have been developed is

Expression (1) implies that the strength of a portfolio is concave in \(n_i\), suggesting that it increases with the size of the portfolio but at a decreasing rate.

A key feature of our model is that the technologies developed for a territory can also be used, to a given extent, to create products for the other market. This implies that a patent developed within, let’s say, territory 1 can also be practiced in adjacent territory 2. Again, it is useful to refer to industries drawing on complex technologies. In this case, in fact, products often embed technological components that were originally developed in other, usually adjacent, areas and holders of the patents protecting these components can practice them in the adjacent territory too.

Formally, we denote with \(\alpha (\beta )\) the degree to which patents developed for an area can be used to appropriate value in the adjacent area. Therefore, the strength of firm i’s portfolio in the adjacent territory is

We assume that \(\alpha (\beta )\in [0,1]\) and \(\alpha '(\beta )>0\), i.e. the strength of patents in the adjacent area increases with the degree of technological overlap. Both \(\sigma\) and \(\alpha (\beta )\) can be interpreted as measures of the protection conferred to the patent holder by the legal system; clearly, the larger \(\sigma\) and \(\alpha (\beta )\), the stronger the protection.

Once firms have built their patent portfolios, they enter into cross-licensing negotiations to share the industrial profits they generate. We assume that there is one cross-licensing negotiation for each territory and that, for the sake of simplicity, the two negotiations are independent one from the other. If firms fail to reach an agreement they go before a Court which decides whether and which patent portfolio has been infringed. As we specify below, the decision of the Court depends on the strength of patent portfolios.

To clarify, let us consider area 1 and suppose that there is technological separation, with firm i that has developed technologies for area 1 and firm j for area 2. From our previous discussions, we know that industrial profits in market 1 are \(\Phi (\beta )\) and that the strength of i’s and j’s portfolios are \(\sigma \ln n_{i}\) and \(\alpha (\beta )\sigma \ln n_{j}\), respectively. Suppose that firms fail to reach an agreement and that, therefore, they go to Court. In line with the analysis of Choi and Gerlach (2017), the Court’s assessment of which portfolio has been breached can generate four possible scenarios: i) firm i is found not to infringe on j’s portfolio while firm j is found to infringe on i’s portfolio, ii) firm j is found not to infringe on i’s portfolio while firm i is found to infringe on j’s portfolio, iii) both firms infringe on the other firm’s portfolio, and iv) neither firm is found to infringe on the other’s patent portfolio. In cases i) and ii), one firm – the one whose portfolio is infringed – can block the rival, and we assume that it receives all the industrial profits. In cases iii) and iv), no firm prevails in Court (both firms can block each other or neither firm can block the other), and we assume that industrial profits are equally split between the two firms.

We assume that the strength of a firm’s portfolio determines the probability that the portfolio is infringed by the rival.Footnote 6 This implies that outcome i) occurs with probability \(\left( \sigma \ln n_i\right) \left( 1- \alpha (\beta )\,\sigma \ln n_j\right)\), outcome ii) occurs with probability \(\left( 1-\sigma \ln n_i\right) \left( \alpha (\beta )\,\sigma \ln n_j\right)\), outcome iii) with probability \(\left( \sigma \ln n_i\alpha (\beta )\right) \left( \sigma \ln n_j\right)\), and outcome iv) with probability \(\left( 1-\sigma \ln n_i\right) \left( 1- \alpha (\beta )\,\sigma \ln n_j\right)\).Footnote 7 Firm i’s expected profits in case of litigation are therefore:

where L indicates the costs of litigation that firms incur when they go to Court.

The previous expression boils down to:

Firm i’s ability to appropriate industrial profits depends on the relative strength of its portfolio compared to that of firm j; if the strength is the same, then firms equally share the value \(\Phi (\beta )\). The expected profits in case of litigation shown in expression (2) represent the threat point of firm i in the Nash bargaining cross-licensing negotiations. Assuming that firms have the same bargaining power, the share of the industrial value \(\Phi (\beta )\) accruing to firm i is the value of s which solves the following Nash bargaining problem:

Solving this maximization problem allows us to determine how much firm i is expected to obtain from the cross-licensing negotiation with firm j in area 1. It can be seen immediately that this payoff corresponds to the firm threat point given in expression (2), net of the litigation costs. Following the same logic, it is possible to define the firms’ expected payoffs in the two areas in the relevant scenarios, that is with separation (firm i in area 1 and firm j in area 2) and with agglomeration in area 1. Table (2) below shows these payoffs.Footnote 8

Clearly, the overall payoff that each firm is able to collect is simply the sum of the profits it obtains in each area.

Industrially efficient technological choices.Footnote 9 Before determining the equilibrium of the game, it is useful to pinpoint the efficient technological choice i.e. the choice that maximizes industrial profits in the two areas. The last column of Table 1 sets out the sum of industrial profits depending on whether technological separation or technological agglomeration emerges. From these values it follows that agglomeration is desirable from the industrial point of view when \(\widehat{\Phi }+\Psi (\beta )\ge 2 \Phi (\beta )\) while separation is preferred otherwise. The following lemma summarizes this observation:

Lemma 1

Agglomeration is desirable from the industrial point of view when \(\Phi (\beta )\le \Phi _1(\beta )\), where \(\Phi _1(\beta )=\left( \widehat{\Phi }+\Psi (\beta )\right) /2\), while separation is desirable otherwise.

When the industrial profits \(\Phi (\beta )\) generated in each area in the case of separation are small compared to \(\widehat{\Phi }\) and \(\Psi (\beta )\), then agglomeration is more efficient. This condition might hold, for instance, when \(\widehat{\Phi }\) is large because of the presence of large research complementarities among firms developing technologies for the same area. On the contrary, separation can be desirable when firms operating in the same technological area largely duplicate their research efforts and agglomeration generates little additional value.

3 Analysis and results

In the previous section, we characterized the cross-licensing negotiations taking place at stage three. We now move to the first two stages. There are two possible first stage equilibria: agglomeration, whereby both firms choose the same area, either area 1 or 2, and separation whereby firms select different territories. Given the symmetry of our model, without loss of generality, in what follows we assume that firm A chooses area 1 and we then focus on the technological choice of firm B. Therefore, the two relevant sub-games to consider are:

-

1)

firm A has chosen technological territory 1 while B has chosen territory 2 (technological separation);

-

2)

both firms have chosen technological territory 1 (technological agglomeration).

We start with the analysis of the first sub-game.

3.1 Patenting in the case of technological separation

In the case of technological separation, industrial profits in each of the two areas are \(\Phi (\beta )\). Firms share these profits through cross-licensing negotiations and the amounts that each firm is able to appropriate in each area are given in Table 2. The overall profits firm \(i=A,B\) collects in the two markets are therefore:

The first term represents the profits firm i collects in the market for which it has developed the technologies and in which its patent portfolio has full strength, \(\sigma \ln n_{i}\). The second term shows the profits i collects in the adjacent market where its patents have strength \(\alpha (\beta ) \sigma \ln n_{i}\). The last term \(n_i\) is the cost of patenting. The superscript 1, 2 in \(\pi _{i}^{1,2}(n_i,n_j)\) reminds us that we are in the sub-game where firm A has chosen area 1 and firm B area 2.

From the first order conditions it is possible to determine the optimal number of patents filed by each firm:

Note that firms file the same number of patents and that this number increases i) the larger the industrial profits generated in each area, \(\Phi (\beta )\), ii) the stronger the protection guaranteed by patents (the larger \(\sigma\) and \(\alpha (\beta )\)), and iii) the greater the technological overlap between the two areas, that is \(\ dn^{1,2}/d\beta >0\). The reason for i) is obvious: the larger the industrial profits, the greater the incentives for firms to patent in order to appropriate them; as ii) is concerned, stronger patents make portfolios more effective in appropriating profits, and this induces firms to patent more aggressively. Finally iii) is essentially a combination of the previous two effects. With greater technological proximity, patents become more effective in appropriating profits in the adjacent market – i.e. \(\alpha (\beta )\) increases with \(\beta\) – and this induces firms to patent more. In addition, industrial profits \(\Phi (\beta )\) increase with \(\beta\) due to a stronger spillover effect across areas; this also creates incentives to patent.

Plugging expression \(n^{1,2}\) into \(\pi _{i}^{1,2}(n_i,n_j)\) we obtain the profits that each firm earns in the case of technological separation:

In equilibrium, firms apply for the same number of patents and therefore end up sharing the overall industrial profits equally. This means that firms equilibrium profits are identical and equal to half of the industrial profits generated in the two areas, net of the patenting costs. Simple inspection of \(\pi ^{1,2}\) reveals:

Remark 1

In case of separation, firms profits decrease with the strength of patents. Formally, \(\pi ^{1,2}\) is a decreasing function of \(\sigma\) and \(\alpha (\beta )\) .

We have just observed that when patents provide a stronger protection, firms patent more aggressively; as a consequence, costs increase for the two firms. At the same time industrial profits, which do not change with the number of patents, are equally split between them. This explains the remark. In this setting, investing in patents represents a waste of resources and the model resembles a typical prisoners’ dilemma game, with firms that invest in costly patents but would be better off agreeing not to apply for any.

While the effect of patent strength on firms profits is clear, that of \(\beta\) is uncertain. On the one hand, when the degree of technological proximity between the two areas is larger, firms are induced to patent more aggressively; this reduces profits. On the other hand, spillovers positively affect the value firms generate in the two areas; this additional effect clearly pushes profits up. Which effect dominates is unclear and the effect of \(\beta\) on profits remains, in general, undetermined.

3.2 Patenting in the case of technological agglomeration

When both firms develop technologies for area 1, industrial profits are \(\widehat{\Phi }\) in this area, and \(\Psi (\beta )\) in area 2 and patent portfolios are stronger when practiced in area 1; hence, the overall profits firm \(i=A,B\) collects in the two areas are

The first term corresponds to the profits collected in area 1, while the second term to those obtained in area 2. The superscript 1, 1 in \(\pi _{i}^{1,1}(n_i,n_j)\) tells us that we are in the sub-game where both firms select area 1.

Solving firms first order conditions, we immediately obtain the number of patents firms invest in with agglomeration:

As in the case of separation, firms file the same number of patents, and this number increases with \(\sigma\), \(\alpha (\beta )\) and \(\beta\). Plugging expression (5) in \(\pi _{i}^{1,1}(n_i,n_j)\) we can determine the level of profits each firm obtains when they both select technology area 1:

Similarly to the case of separation, firms share the industrial profits \(\widehat{\Phi }+\Psi ( \beta )\) equally. This means that the equilibrium profits \(\pi ^{1,1}\) are half of the industrial profits generated in the two areas, net of the patenting costs. Simple inspection of \(\pi ^{1,1}\) reveals:

Remark 2

In the case of agglomeration, firms’ profits decrease with patent strength. Formally, \(\pi ^{1,1}\) is a decreasing function of \(\sigma\) and \(\alpha (\beta )\).

For the same reason as before, an increase in \(\sigma\) and \(\alpha (\beta )\) reduces profits. The effect of greater technological proximity is uncertain as it impacts negatively on profits through its effect on patenting, but it impacts positively on industrial profits via the effect on \(\Psi (\beta )\).

Before moving to the first stage of the game, it is useful to compare the number of patents firms obtain in the cases of agglomeration and separation, \(n^{1,1}\) and \(n^{1,2}\) respectively. This comparison is important. Firms take their technological decisions before the patenting stage. This means that the decision of a firm to agglomerate or to separate affects the patenting incentives of the competitor; we refer to this as the strategic effect of the technological choice. In turn, this effect influences the technology decisions, as we clarify in the next subsection.

Remark 3

Comparing \(n^{1,1}\) and \(n^{1,2}\) it follows that:

-

i)

\(n^{1,1}>n^{1,2}\) iff \(\Phi (\beta ) < \Phi _2(\beta )\) , where \(\Phi _2(\beta )=\left( \widehat{\Phi }+\alpha (\beta )\Psi (\beta )\right) /\left( 1+\alpha (\beta )\right)\) , with \(\Phi _2(\beta )>\Phi _1(\beta )>\Psi (\beta )\) ;

-

ii)

\(|n^{1,1}-n^{1,2}|\) increases with \(\sigma\) ;

-

iii)

\(n^{1,1}-n^{1,2}\) decreases with \(\alpha (\beta )\) .

Patenting incentives are proportional to the profits a firm is able to collect and to \(\sigma\), the patent strength. Part i) of the corollary shows that when \(\Phi (\beta ) < \Phi _2(\beta )\), profits are larger under agglomeration, and therefore \(n^{1,1}>n^{1,2}\). Interestingly, this implies that there is a misalignment between patenting incentives and efficiency in the technological choice. Agglomeration is efficient when \(\Phi (\beta ) < \Phi _1(\beta )\), and therefore when \(\Phi (\beta )\in (\Phi _1(\beta ),\Phi _2(\beta ))\), firms patent more intensively when they select the same technological area even though separation generates larger industrial profits. The reason for this misalignment is that the effectiveness of patents in appropriating profits depends on the technological area where they are practiced, and it is less than perfect when patents are employed in the adjacent area. Part ii) of the corollary shows that the difference between \(n^{1,1}\) and \(n^{1,2}\), either positive or negative, increases with \(\sigma\). The reason for this is related to the fact that patenting is proportional to patent strength and therefore the effect of the difference in the profits the firms collect under separation and agglomeration gets stronger the larger \(\sigma\). As we discuss in the next subsection, part ii) of the corollary is very important for our scopes as it implies that the strategic effect of the technological choice on the incentives to patent of the competitor (i.e. the difference in firms patenting) grows stronger the more effective the patents. Part iii) of the remark looks at \(\alpha (\beta )\), the effectiveness of patents in appropriating profits in the adjacent market. In general, patenting incentives increase with \(\alpha (\beta )\), as we have already observed in Remarks 1 and 2. However, part iii) of Remark 3 highlights a clear result according to which, as \(\alpha (\beta )\) increases, firms tend to patent more intensively under separation. Also this result has a rather intuitive explanation. The profits available in the adjacent market are larger under separation than under agglomeration (formally, \(\Phi (\beta )>\Psi (\beta )\)). As a consequence, as patents become more effective in extracting profits in the adjacent market, the increase in patenting is more pronounced under separation.

3.3 Technology choice

We are now in the position to determine the technological choice of firm B. In order to discuss this decision, it is useful to formalize the difference in B’s profits under separation and under agglomeration; using the expressions we derived above one can show that:

Firm B separates when expression (7) is positive, and otherwise agglomerates. This expression shows that B’s decision is driven by what we call the ‘direct’ and the ‘strategic’ effects. The direct effect encourages firm B to take the efficient decision stated in Lemma 1 simply because, by doing so, it generates larger industrial profits. Hence, the direct effect induces firm B to choose separation for \(\Phi (\beta )>\Phi _1(\beta )\) and agglomeration otherwise. The strategic effect is related to the fact that B’s technological decision impacts on A’s patenting incentives. Therefore, when choosing whether to separate or agglomerate, B also attempts to strategically limit the patenting activity of the competitor. From Remark 3, point i), we know that if \(\Phi (\beta )<\Phi _2(\beta )\), firm A patents more aggressively when B agglomerates; as a consequence, firm B can be induced to separate in order to strategically reduce A’s amount of patents and, consequently, to limit its competitor’s bargaining power. When \(\Phi (\beta )>\Phi _2(\beta )\), the opposite occurs, with firm B more willing to agglomerate to reduce A’s patenting incentives. Remark 3, at point ii), also suggests that the effect of B’s technological choice on A’s patenting, becomes stronger as \(\sigma\) increases. Putting together these arguments, the following proposition holds:

Proposition 1

The technological choice of firm B is:

-

i)

when \(\Phi (\beta )<\Phi _1(\beta )\) , firm B agglomerates for \(\sigma \le \overline{\sigma }\) and separates otherwise;

-

ii)

when \(\Phi _1(\beta )\le \Phi (\beta )<\Phi _2(\beta )\) , firm B separates;

-

iii)

when \(\Phi (\beta )\ge \Phi _2(\beta )\) , firm B separates for \(\sigma \le \overline{\sigma }\) and agglomerates otherwise,

where \(\overline{\sigma }=\frac{2(\Phi (\beta )-\Phi _1(\beta ))}{(1+\alpha (\beta ))(\Phi (\beta )-\Phi _2(\beta ))}\) .

Proposition 1 shows that three scenarios can emerge. When \(\Phi (\beta )<\Phi _1(\beta )\) the direct and the strategic effects move in opposite directions: the direct effect calls for agglomeration and the strategic effect for separation. As long as patents are not too strong, the direct effect dominates and firm B chooses agglomeration; when \(\sigma\) is large enough, patents are very strong, the strategic effect dominates and firms separate. The opposite occurs when \(\Phi (\beta )>\Phi _2(\beta )\); in this case, the direct effect calls for separation and the strategic effect for agglomeration. Again, only if \(\sigma\) is not too large, the direct effect dominates and separation occurs. Finally, when \(\Phi _1(\beta )<\Phi (\beta )<\Phi _2(\beta )\) both effects call for separation and, irrespectively of \(\sigma\), firm B opts for separating into technological area 2.

In order to provide a visual representation of the equilibrium, Figure 1 graphically represents the difference \(\pi ^{1,2}-\pi ^{1,1}\); when this difference is positive, firm B chooses to separate and, when it is negative, B prefers technology area 1 and agglomeration occurs. The plot is drawn assuming that, for a given value of \(\beta\), \(\widehat{\Phi }=3\), \(\Psi (\beta )=0.3\) and \(\alpha (\beta )=0.95\); these values mean that \(\Phi _1(\beta )=1.65\) and \(\Phi _2(\beta )=1.685\). In the figure, the profit difference is shown for three different levels of \(\Phi (\beta )\), one for each region highlighted in Proposition 1: i) \(\Phi (\beta )=1.3\), ii) \(\Phi (\beta )=1.67\) and iii) \(\Phi (\beta )=2\).Footnote 10

Combining Lemma 1 and Proposition 1 we can pinpoint the cases in which firm B takes an inefficient technological decision.

Corollary 1

When \(\sigma \ge \overline{\sigma }\) : a) there is industrially inefficient separation if \(\Phi (\beta )<\Phi _1(\beta )\) and b) there is industrially inefficient agglomeration i f \(\Phi (\beta )>\Phi _2(\beta )\) .

Interestingly, Corollary 1 shows that strong patent rights may distort the firms’ technological choices, leading either to excessive separation or to excessive agglomeration. The Corollary also reveals that an increase in patent strength, \(\sigma\), undoubtedly harms efficiency. Returning to the simulations shown in Figure 1, it turns out that when \(\Phi (\beta )=1.3\), \(\overline{\sigma }=0.93\) and separation occurs when agglomeration is optimal for \(\sigma > 0.93\); when \(\Phi (\beta )=2\), \(\overline{\sigma }=1.14\) and there is inefficient agglomeration for \(\sigma > 1.14\).

3.4 Comparative statics

3.4.1 The effect of patent strength in the adjacent area, \(\alpha (\beta )\)

It is now time to take a closer look at the role of \(\alpha (\beta )\). The degree to which patent protection extends from one territory to the other is primarily determined by their technological proximity. However, to a certain extent, it may also be a lever in the hands of policymakers and regulators. A relevant example is the so-called ‘means-plus-function’ provision enabling functional claims, i.e. claims that describe subject matter in terms of what it does rather than what it is.Footnote 11 In the US, functional claiming was statutory introduced in the 1952 Patent Act and, alongside structural claiming, represents a method for defining patent claims and, therefore, the extent of patent protection. It is widely accepted that in some sectors, and specifically in software, the application of the means-plus-function has allowed innovators to obtain extremely broad patents (Miller and Tabarrok 2014) i.e., in our setting, patents characterized by a large value of \(\alpha (\beta )\). A direct consequence of Remark 3 is the following:Footnote 12

Corollary 2

A policy that, for a given \(\beta\) , increases \(\alpha (\beta )\) stimulates agglomeration.

When the degree to which patents can be practiced in the adjacent territory increases, firms are induced to patent more intensively both when they separate and when they agglomerate. Nonetheless, from point iii) of Remark 3 we know that firms tend to patent relatively more with separation; this suggests that a greater \(\alpha (\beta )\) favors agglomeration.

3.4.2 The role of technological proximity, \(\beta\)

Before moving on to the extensions of our baseline model, it is interesting to look more closely at the role of technological proximity. This analysis is rather complex, as \(\beta\) impacts both on the industrial profits in the two areas and on \(\alpha (\beta )\), the degree to which firms can use patents to extract value from the adjacent territory. This means that a change in \(\beta\) influences both the direct and the strategic effects that determine firms’ technological decisions. For analytical purposes, it is helpful to compare firms incentives to agglomerate/separate when the two areas are characterized by a larger or by a smaller degree of technological proximity. Specifically, we consider two distinct pairs of areas differing only in terms of their technological proximity, and then analyze how the incentives to separate/agglomerate differ in the two cases. Formally, let us consider a first pair of areas, with a technological distance of \(\underline{\beta }\), and a second pair with a technological distance of \(\beta =\overline{\beta }\) and, without loss of generality, let us assume that the two areas of the second pair are characterized by greater technological proximity: \(\underline{\beta }<\overline{\beta }\).

We can now compare the incentives to separate/agglomerate in the two cases. Specifically, by employing expression (7), it follows that firms are more likely to agglomerate when \(\beta =\overline{\beta }\) rather than when \(\beta =\underline{\beta }\) if

Using the expression for \(\Phi _2(\beta )\) shown in Remark 3, it is convenient to re-write this inequality as follows:

Term (1) of expression (8) measures the difference in the direct effects when the two areas are technologically close, \(\beta =\overline{\beta }\), and distant, \(\beta =\underline{\beta }\). It suggests that if, for instance, agglomeration becomes relatively more efficient than separation as \(\beta\) increases, then term (1) is negative and firms are more likely to invest in the same area when technological proximity is large. Terms (2) and (3) measure the difference in the strategic effects due to the change in the incentives to patent. Term (2) accounts for the fact that technological proximity impacts on industrial profits \(\Phi (\beta )\) and \(\Psi (\beta )\), thus influencing patenting incentives. The term is negative when the increase in profits under separation, \(\Phi (\overline{\beta })-\Phi (\underline{\beta })\), is large compared to \(\Psi (\overline{\beta })-\Psi (\underline{\beta })\), the variation in profits under agglomeration. In this case, patenting increases more markedly under separation, and this fact implies that strategic reasons induce firms to prefer agglomeration when \(\beta\) is large.Footnote 13 Term (3) instead represents the second effect of a change in technological proximity on patenting incentives. An increase in \(\beta\) makes patents more effective in appropriating value in the adjacent market and, because of this, it enlarges the patenting incentives. This second effect of technological proximity on patenting is proportional to the difference in the values of \(\alpha ({\beta }\)). Since \(\alpha (\overline{\beta })>\alpha (\underline{\beta })\), one can immediately see that term (3) is negative, implying that agglomeration becomes more profitable than separation as \(\beta\) increases; intuitively, this fact follows from point iii) of Remark 3 according to which an increase in \(\alpha ({\beta })\) makes patenting more intense under separation, thus reducing the profitability of such technological choice.

While term (3) implies that agglomeration tends to prevail when areas are technologically close, terms (2) and (3) may move in opposite directions. Even though a general conclusion regarding the effect of technological proximity cannot be drawn, there are nonetheless some clear insights in a specific yet interesting case. Suppose that the direct effect when \(\beta =\overline{\beta }\) is the same as when \(\beta =\underline{\beta }\). Formally, suppose that term (1) in expression (8) is zero, then it is possible to prove the following:

Corollary 3

Consider two pairs of adjacent areas with different degrees of technological proximity. Suppose that the change in \(\beta\) does not affect the relative efficiency of separation vs agglomeration (formally, suppose that term 1 in expression (8) is zero), then: i) firms are more likely to agglomerate when the areas are characterized by greater technological proximity, \(\beta =\overline{\beta }\); ii) firms are more likely to separate when the areas are characterized by lesser technological proximity, \(\beta =\underline{\beta }\).

When term (1) is zero, the relative efficiency of separation vs agglomeration does not vary with \(\beta\) and, therefore, the effect of proximity on firms’ technological choices is driven by the strategic effect only. Corollary 3 shows that, strategic motives tilt firms’ decisions towards agglomeration when \(\beta\) is large and towards separation for smaller values of technological proximity. Formally, term (1) equalling zero requires a proportionality in the change in industrial profits under separation \(\Phi (\overline{\beta })-\Phi (\underline{\beta })\) and under agglomeration \(\Psi (\overline{\beta })-\Psi (\underline{\beta })\). This fact makes term (2) negative, reinforcing the effect of term (3) and explaining the results shown in the corollary.

4 Extensions

4.1 Asymmetric market values

So far we have assumed that markets are symmetrical and, in the case of separation, generate the same industrial profits \(\Phi (\beta )\). It is interesting to analyze an asymmetric environment, where one area is more valuable than the other. This analysis is useful not only to characterize the different incentives towards agglomeration/separation in an asymmetric setting, but also because it allows us to extend the model to the case in which one firm is financially constrained and cannot patent more than a certain amount of technologies. This extension, involving a scenario with practical relevance, is the focus of the next section.

Let us assume that area 1 is more profitable than area 2. Specifically, suppose that, in the case of separation, industrial profits are \(\Phi (\beta )+\delta\) in area 1 and \(\Phi (\beta )-\delta\) in area 2; \(\delta \ge 0\) indicates the degree of asymmetry between the two markets. By contrast, profits in the case of agglomeration are still \(\hat{\Phi }\) and \(\Psi (\beta )\).Footnote 14 This way of modeling the asymmetry has the property of not affecting the overall amount of industrial profits firms collect in the two markets; therefore, irrespective of \(\delta\), the conditions for which agglomeration/separation is efficient are still those given in Lemma 1.

As before, without loss of generality, we can assume that one firm – firm A – chooses area 1; whether separation or agglomeration occurs depends on firm B’s technological decision. The subgame with agglomeration is the same as in Section 3 and profits at the subgame equilibrium are as in expression (6). When firm B separates and chooses area 2, profits are:

From the first order conditions it is possible to determine the optimal number of patents obtained by the two firms:

It is interesting to note that A’s patents increase with \(\delta\) while those of firm B decrease; this means that the greater the asymmetry, the more firm A improves its bargaining position with the competitor. Plugging \(n^{1,2}_{a}\) and \(n^{1,2}_{b}\) in \(\pi _{i}^{1,2}(n_i,n_j)\), we obtain the firms’ profits in this subgame. Comparing the profits firm B obtains with separation and with agglomeration the following poposition can be proved:

Proposition 2

The larger the asymmetry in firms profits when they separate, the more firms agglomerate in high valued area 1.

This result has a clear interpretation. The larger \(\delta\) the lower the incentives to separate and build a patent portfolio which is fully effective in area 2 but less than fully effective in the more profitable area 1. Hence, asymmetry in the profitability of the two markets is another potential source of inefficiency, tilting firms technological decisions towards the most lucrative market. Specifically, as \(\delta\) does not impact on the industrial profits, Proposition 2 suggests that asymmetry may induce an inefficient technological choice when separation is optimal. By contrast, when agglomeration is efficient, asymmetry may avoid the market outcome of inefficient separation, thus reducing the distortion shown in part a) of Corollary 1.

4.1.1 Firm B is financially constrained

The previous section suggests an interesting extension which is worth discussing. In our analysis we assume that firms can apply for the number of patents they wish. However, in some circumstances firms might have a limited patenting capacity. For instance, SMEs might lack the expertise to file patent applications, might be unable to actually enforce patents − a fact that would drastically reduce the benefits of applying for patent protection in the first place − or they might simply be financially constrained. In this section, we study what happens to a firm when, for any reason, it is limited in the number of patents it can apply for. Specifically, we assume that, regardless of its technological decision, firm B can apply for at most \(\overline{n}\) patents, a number below its optimal/desired level; formally, \(\overline{n}<min\{n_b^{1,1}, n_b^{1,2}\}\).

In this setting, firms are no longer symmetrical and, therefore, to characterize the equilibrium we need to explicitly determine the technological choice of each firm. This analysis is beyond the scope of this section. What we are interested in studying here is much simpler and essentially boils down to answering the following question: suppose that the unconstrained firm A has chosen the more lucrative area 1, does a more stringent constraint of B’s ability to patent stimulate more agglomeration or more separation?

In order to discuss this issue, it is useful to reinterpret the difference between B’s profits when it separates and those when it agglomerates as the incentive to separate. The next proposition shows the effect of a more stringent constraint (lower \(\bar{n}\)) on B’s technological choice.

Proposition 3

A more stringent constraint on the number of patents firm B can apply for (lower \(\bar{n}\)): i) favors agglomeration if, without constraint, firm B would patent more when it separates than when it agglomerates (\(n_b^{1,2}>n_b^{1, 1}\)), ii) favors separation if, without constraint, firm B would patent more when it agglomerates than when it separates (\(n_b^{1,2}<n_b^{1, 1}\)).

Proposition 3 can be interpreted fairly simply: firm B is more likely to choose the technological option which is less damaged by the constraint. Hence, if unconstrained, firm B would patent more in the case of agglomeration (\(n_b^{1,2}<n_b^{1, 1}\)), when it faces the constraint the firm would be much more severely affected by the constraint if it agglomerates than if it separates; as a consequence, a more stringent constraint (smaller \(\bar{n}\)) is likely to induce firm B to opt for this latter, ‘less painful’, option. The opposite occurs when \(n_b^{1,2}>n_b^{1, 1}\).

At this point, one may wonder whether a more stringent constraint aggravates the inefficiency in the technological choice. This issue is discussed in the next corollary.

Corollary 4

When \(\Phi (\beta )<\Phi _1\) or \(\Phi (\beta )>\Phi _2+\delta (1-\alpha (\beta ))/(1+\alpha (\beta ))\) , a more stringent constraint generates more inefficiency.

When \(\Phi (\beta )\) is small (smaller than \(\Phi _1\)) aggregation is efficient and \(n_b^{1,2}<n_b^{1, 1}\). In this case, a tighter constraint on \(\bar{n}\) favors separation thus aggravating the potential inefficiency in the technological choice of firm B. Inefficiencies may aggravate when \(\Phi (\beta )\) is large (larger than \(\Phi _2+\delta (1-\alpha (\beta ))/(1+\alpha (\beta ))\)) for the opposite reason: for large values of \(\Phi (\beta )\) separation is efficient, \(n_b^{1,2}>n_b^{1, 1}\) but a smaller \(\bar{n}\) induces more agglomeration. Only when \(\Phi (\beta )\) takes intermediate values then a reduction in \(\bar{n}\) limits the inefficiencies arising in the technological choice of firm B.Footnote 15

5 Conclusions

In high-tech sectors, technologies are often covered by so-called patent thickets and firms strategically amass large patent portfolios in the attempt to extract greater portions of profits when negotiating licensing contracts with their competitors. In this paper, we develop a theoretical model showing that, in such contexts, patents may distort the direction of the technological trajectories pursued by firms. Specifically, firms may refrain from choosing efficient research trajectories to induce competitors to patent less intensively. This may lead firms to invest excessively in the same (excessive agglomeration) or in different technological trajectories (excessive separation). Our theoretical analysis confirms the implications of the empirical literature. In high-tech sectors, patents may have distortionary effects on R&D activities; this is especially the case of the software industry where, according to scholars, excessively broad patent protection is having detrimental consequences on the development of the industry (Bessen and Meurer 2008). Our analysis, therefore, reinforces the claim that in industrial contexts where patents have a marked strategic content, excessively strong patent protection may lead to inefficient outcomes.

Our model also highlights the type of distortion that may emerge due to the strategic role of patents. In the presence of a high degree of technological overlap between the areas where firms operate, our model shows that strategic reasons tilt the technology decisions of firms toward agglomeration. By contrast, strategic reasons tend to lead to separation when the degree of technological overlap between areas is more limited.

Our analysis also suggests that in these markets, where the ability to patent technologies represents an important requirement in order to compete, companies with limited patent capacity such as SMEs or, in general, firms lacking the expertise or the financial capability to file patent applications, may find it difficult to operate.

With this paper we also contribute to the theoretical literature on the role of patents. Most of the available studies focus on the scale of R&D activities, and there are far fewer articles that study how patents affect the direction of research. In this context, we contribute by analyzing the strategic role of patents in the presence of some specific features such as those characterizing high-tech markets. In doing so, we have abstracted from the positive role that patents may have, namely that of stimulating research activities. This allowed us to obtain sharper and clearer results. When interpreting our analysis and its implications, attention should be paid to the more nuanced role that patents have in reality.

Change history

22 July 2022

Missing Open Access funding information has been added in the Funding Note.

Notes

This view is challenged by Galasso and Schankerman (2010). Using data on patent disputes in district courts in the U.S., they show that fragmentation accelerates licensing negotiations, thus stimulating the use of patent technologies rather than discouraging it. The authors interpret this finding using the argument put forward by Lichtman (2006): as fragmentation increases, the value of each patent shrinks and this reduces the incentives for patent holders to negotiate aggressively.

In Hall et al. (2013) entry is defined as the decision to patent for the first time in a given technological field. On similar lines, Cockburn et al. (2010) find a significant effect of fragmentation on innovative activities for firms that need to in-license the technology they use. For these firms the presence of patent thickets markedly reduces the share of revenues they are able to collect from selling new products.

An interesting theoretical contribution that looks at the direction of research projects is presented by Bryan and Lemus (2017). The authors show that two types of distortions can arise. On the one hand, firms may excessively invest in ‘easy to obtain’ yet less valuable research projects. On the other, differences in the degree of appropriability of returns may induce firms to invest too often in R&D projects which are more difficult to develop but for which appropriation is less a problem.

Clearly, our analysis would be meaningless if firms could enter both areas at the same time and at no cost. In line with the empirical evidence discussed in the introduction, we are implicitly assuming that firms have limited resources and they can invest in only one territory.

In our setting, we disregard the positive role patents have on the incentives to invest in R&D. Patents have the only aim of determining how firms share industrial value; therefore, given that firms face a cost for patenting, they are intrinsically inefficient.

In modeling the strength of patent portfolios, we follow Choi and Gerlach (2017) and consider them as common knowledge. Differently from Choi and Gerlach (2017), we assume that whatever the outcome \(i)-iv)\) the sum of profits obtained by the two firms is always \(\Phi (\beta )\). This assumption allows us to concentrate on the role of patenting as a determinant of firm technological choices and to abstract from other factors – such as the degree of competition – that may influence the decisions of firms.

Throughout the paper we assume that parameters are such that we have an interior solution and probabilities are between zero and one. In Sect. 3, we provide numerical simulations that highlight parameter values for which this actually occurs.

Interestingly, we would obtain qualitatively the same results assuming that patent portfolios impact directly on firms bargaining power rather than on the threat points. Technical details of this alternative modeling of the bargaining are available on request from the authors.

We define efficiency looking at industrial profits only. A more general analysis considering social efficiency would require modeling competition in product markets explicitly. Nonetheless, in some specific cases, our definition of efficiency corresponds to the more general concept of social efficiency. For example, this occurs when firms are symmetrical, both before and after technologies are developed, and if they compete in quantities. Under these assumptions, social welfare turns out to be proportional to producers surplus and, when this happens, industrial efficiency involves the maximization of social welfare. Examples of cases in which this occurs are available from the authors on request.

For these parameter values and given \(\sigma \in (0.8, 1.19)\), the probabilities of the two firms infringing the portfolio of the rival are between 0 and 1, and the three scenarios of Proposition 1 can be fully characterized.

According to US patent law, functional claims are allowed provided they are limited by a specific means.

The remark can be proved by taking the derivative of expression (7) with respect to \(\alpha\).

The intuition for this result follows from point i) of Remark 3 according to which patenting is more intense under separation – a fact that induces firms to agglomerate – when \(\Phi (\beta )\) is large.

Clearly, continue to assume that \(\Phi (\beta )+\delta \le \hat{\Phi }\) and that \(\Phi (\beta )-\delta \ge \Psi\) with the equalities that may hold when \(\beta =1\).

However, it should be stressed that the game we are analyzing here is based on the assumption that firm A chooses the most profitable technological area 1. While this simplification does not entail any loss in generality in the symmetric game, in the presence of asymmetries between firms a more complete analysis of the equilibrium would require the technology choice of firm A also to be studied.

References

Bessen J, Meurer M (2008) Patent failure: how judges, bureaucrats, and lawyers put innovators at risk. Princeton University Press, Princeton, NJ

Bhattacharya S, Mookherjee D (1986) Portfolio choice in research and development. RAND J Econ 17(4):594–605

Bryan KA, Lemus J (2017) The direction of innovation. J Econ Theory 172:247–272

Capuano C, Grassi I, Martina R (2020) Patent protection and threat of litigation in oligopoly. J Econ 130:109–131

Cardon JH, Sasaki D (1998) Preemptive search and R&D clustering. RAND J Econ 29(172):324–338

Chatterjee K, Evans R (2004) Rivals’ search for buried treasure: competition and duplication in R&D. RAND J Econ 35(1):160–183

Chen Y, Pan S, Zhang T (2018) Patentability, R&D direction, and cumulative innovation. Int Econ Rev 59(4):1969–1993

Choi J, Gerlach H (2017) A theory of patent portfolios. Am Econ J Microecon 9(1):315–51

Cockburn IM, MacGarvie MJ, Mueller E (2010) Patent thickets, licensing and innovative performance. Ind Corp Chang 19(3):899–925

Cohen WM, Nelson RR, Walsh JP (2000) Protecting their intellectual assets: appropriability conditions and why US manufacturing firms patent (or not). NBER working paper, 7552

Comino S, Manenti FM, Thumm N (2019) The role of patents in information and communication technologies: a survey of the literature. J Econ Surv 33(2):404–430

Dasgupta P, Maskin E (1987) The simple economics of research portfolios. Econ J 97(387):581–595

Farrell J, Gilbert R, Katz ML (2002) Market structure, organizational structure, and r&d diversity. UC Berkeley Competition Policy Center Working Paper No. CPC02-34

Galasso A, Schankerman M (2010) Patent thickets, courts, and the market for innovation. RAND J Econ 41(3):472–503

Graham SJ, Merges RP, Samuelson P, Sichelman T (2009) High technology entrepreneurs and the patent system: results of the 2008 Berkeley patent survey. Berkeley Technol Law J 24(4):1255

Hall B, Helmers C, von Graevenitz G, Rosazza-Bondibene C (2013) A study of patent thickets. Intellectual Property Office

Hall BH, Harhoff D (2012) Recent research on the economics of patents. Annu Rev Econ 4(1):541–565

Hall BH, Ziedonis RH (2001) The patent paradox revisited: an empirical study of patenting in the US semiconductor industry, 1979–1995. RAND J Econ 32(1):101–128

Heller MA, Eisenberg RS (1998) Can patents deter innovation? The anticommons in biomedical research. Science 280(5364):698–701

Hopenhayn H, Squintani F (2021) On the direction of innovation. J Polit Econ 129(7):1991–2022

Lerner J (1995) Patenting in the shadow of competitors. J Law Econ 38(2):463–495

Letina I (2016) The road not taken: competition and the R&D portfolio. RAND J Econ 47(2):433–460

Lichtman D (2006) Patent holdouts and the standard-setting process. U Chicago Law and Economics, John M. Olin Working Paper,p 292

Miller SP, Tabarrok A (2014) Ill-Conceived, even if competently administered: software patents, litigation, and innovation. A comment on Graham and Vishnubhakat. Econ J Watch 11(1):37

Moser P (2005) How do patent laws influence innovation? Evidence from nineteenth-century world’s fairs. Am Econ Rev 95(4):1214–1236

Sah RK, Stiglitz JE (1987) The invariance of market innovation to the number of firms. RAND J Econ 18(1):98–108

Shapiro C (2001) Navigating the patent thicket: cross licensing, patent pools, and standard setting. In: Jaffe A, Lerner J, Stern S (eds) Innovation policy and the economy. MIT Press, Cambridge, MA

Torrisi S, Gambardella A, Giuri P, Harhoff D, Hoisl K, Mariani M (2016) Used, blocking and sleeping patents: empirical evidence from a large-scale inventor survey. Research Policy 45(7):1374–1385

von Graevenitz G, Wagner S, Harhoff D (2013) Incidence and growth of patent thickets: the impact of technological opportunities and complexity. J Indus Econ 61(3):521–563

Walsh JP, Arora A, Cohen WM (2003) Effects of research tool patents and licensing on biomedical innovation. In: Cohen W, Merrill S (eds) Patents in the knowledge-based economy, vol 285. National Research Council, Washington, DC

Walsh JP, Lee YN, Jung T (2016) Win, lose or draw? The fate of patented inventions. Research Policy 45(7):1362–1373

Ziedonis RH (2004) Don’t fence me in: fragmented markets for technology and the patent acquisition strategies of firms. Manage Sci 50(6):804–820

Funding

Open access funding provided by Università degli Studi di Padova within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Preliminary versions of the paper were presented at the 2019 EARIE Conference and at the 2020 SIEPI and SIE Conferences. We are grateful to Matthew Mitchell, Alexander Galetovic, Jorge Lemus, Florian Schuett, Alessandro Sterlacchini and Igor Letina for useful comments and suggestions. We also thank three anonymous referees and the editor of the Journal of Economics for their extremely useful comments.

A. Mathematical appendix

A. Mathematical appendix

Proof of Remark 3

Using the expressions for \(n^{1,1}\) and \(n^{1,2}\) it follows that

where \(\Phi _2=\left( \widehat{\Phi }+\alpha (\beta )\Psi (\beta )\right) /\left( 1+\alpha (\beta )\right)\), with \(\Phi _2>\Phi _1\) since \(\widehat{\Phi }>\Psi\). The Remark follows from simple algebraic inspection and differentiation. Note that point iii) holds for any acceptable parameter value as, by construction, \(\Phi (\beta )>\Psi (\beta )\). \(\square\)

Proof of Proposition 1 and Corollary 1

Simple algebra allows us to write \(\pi ^{1,2}-\pi ^{1,1}\) as shown in (7). Recalling that \(\Phi _2>\Phi _1\), then for \(\Phi (\beta )<\Phi _1\) the first term in (7) is negative while the second term is positive and increasing in \(\sigma\). Therefore, \(\pi ^{1,2}-\pi ^{1,1}<0\) and firm B chooses agglomeration when \(\sigma\) is small (\(\sigma <\overline{\sigma }\)). For larger values of \(\sigma\) (\(\sigma >\overline{\sigma }\)) firm B chooses separation; \(\overline{\sigma }\) is such that \(\pi ^{1,2}=\pi ^{1,1}\). These arguments explain part i) of Proposition 1. Parts ii) and iii) follow the same logic.

Corollary 1 follows directly from a comparison between Proposition 1 and Lemma 1. \(\square\)

Proof of Corollary 3

When \(\beta\) does not affect the relative efficiency of separation vs agglomeration, then term (1) in expression (8) is zero, a condition which can be re-written as \(\Phi (\overline{\beta })- \Phi (\underline{\beta })=(\Psi (\overline{\beta })-\Psi (\underline{\beta }))/2\). In turn, this latter condition implies that term (2) in expression (8) is negative. Finally, term (3) is always negative as \(\alpha (\overline{\beta })>\alpha (\underline{\beta })\). \(\square\)

Proof of Proposition 2

B’s profits in the case of agglomeration are not affected by \(\delta\); hence the impact of the asymmetry on firm B’s decision is entirely driven by the effect of \(\delta\) on the profits the firm obtains if it separates. Using some algebra, it is possible to show that B’s equilibrium profits with separation are given by:

where \(n^{1,2}_{i}\) is the the optimal number of firm i’s patents given in expressions (9). The derivative of this expression with respect to \(\delta\) is therefore:

which is always negative. As B’s profits with separation decrease with \(\delta\) while those with agglomeration are not affected by \(\delta\), the proposition follows. \(\square\)

Proof of Proposition 3

Assuming that \(\overline{n}<min\{n_b^{1,1}, n_b^{1,2}\}\), firm B applies for exactly \(\bar{n}\) patents, regardless of its technological choice. Firm A is unconstrained, hence depending on what B does, it is free to apply for its optimal number of patents, \(n_a^{1,1}\) and \(n_a^{1,2}\). Plugging the former into \(\pi _b^{1,1}(n_a,n_b)\) and the latter into \(\pi _b^{1,2}(n_a,n_b)\) and given that \(n_b=\bar{n}\), it is possible to derive firm B’s profit difference under separation and under agglomeration, given \(\bar{n}\):

Simple differentiation reveals that \(d (\pi ^{1,2}_b-\pi ^{1,1}_b)/d \bar{n} = -\sigma \left( \Psi \alpha +\widehat{\Phi } -(1+\alpha )\Phi \right) /(2 \bar{n})\), the sign of which corresponds to the sign of \(n_b^{1,2}-n_b^{1,1}\). \(\square\)

Proof of Corollary 4

From Proposition 3 we know that \(d(\pi ^{1,2}_b-\pi ^{1,1}_b)/d\bar{n}<0\) - a more stringent constraint stimulates separation - if \(n_b^{1,2}<n_b^{1,1}\) or, equivalently, if \(\Phi (\beta )<\Phi _2+\delta (1-\alpha (\beta ))/(1+\alpha (\beta ))\). As aggregation is desirable if \(\Phi (\beta )<\Phi _1\) and provided that \(\Phi _1<\Phi _2\), it follows that when \(\Phi <\Phi _1\) a more stringent constraint stimulates separation when aggregation is desirable. Similarly, from Proposition 3 we know that \(d(\pi ^{1,2}_b-\pi ^{1,1}_b)/d\bar{n}>0\) if \(\Phi (\beta )>\Phi _2+\delta (1-\alpha (\beta ))/(1+\alpha (\beta ))\). As separation is desirable if \(\Phi (\beta )>\Phi _1\), it follows that when \(\Phi (\beta )>\Phi _2+\delta (1-\alpha (\beta ))/(1+\alpha (\beta ))\) a more stringent constraint stimulates agglomeration when separation is desirable. \(\square\)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Comino, S., Manenti, F.M. Patent portfolios and firms’ technological choices. J Econ 137, 97–120 (2022). https://doi.org/10.1007/s00712-022-00783-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-022-00783-x